Invest with the best

This emerging asset class has all of the tax benefits of traditional real estate investing with higher cash flow & return on investment.

Cash flow, tax benefits & wealth creation.

Annual ROI

0%+

Cash Flow + Appreciation + Depreciation + Debt Pay-down is a powerful formula for building wealth.

Annual Cash Flow

10-0%+

Earn double-digit yield on an annual basis to achieve the passive income you want.

Tax Benefits

0%

A formula for building wealth.

Investing in real estate is a powerful vehicle for building wealth and generating cash flow. Simultaneously increase your annual earnings and lower your taxable income.

Who needs industry averages when you have actuals?

$75,000

Our Annual Average Revenue

Average Annual Revenue means (A) the amount equal to the sum of the Revenue for each fiscal year of the Performance Period, divided by (B) the number of fiscal years in the Performance Period.

55%

Our average margin (net profit)

The net profit margin, or simply net margin, measures how much net income or profit is generated as a percentage of revenue. It is the ratio of net profits to revenues for a company or business segment. Net profit margin is typically expressed as a percentage but can also be represented in decimal form.

20%+

Our 5 Year IRRs

The internal rate of return (IRR) is a metric used in financial analysis to estimate the profitability of potential investments. IRR is a discount rate that makes the net present value (NPV) of all cash flows equal to zero in a discounted cash flow analysis. IRR calculations rely on the same formula as NPV does.

$265

Our Average Daily Rate (ADR)

Average Daily Rate is a statistical unit that is often used in the lodging industry. The number represents the average rental income per paid occupied room in a given time period. ADR along with the property’s occupancy are the foundations for the property’s financial performance.

Who needs industry averages when you have actuals?

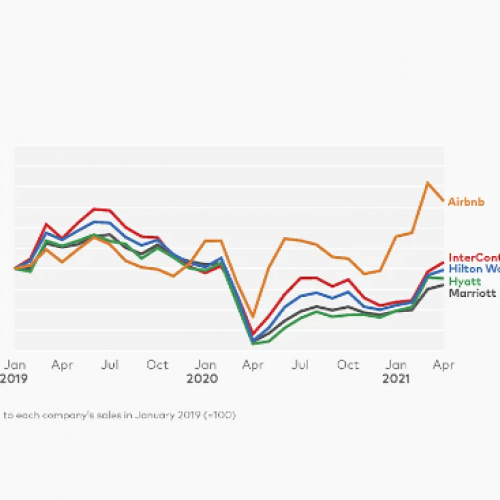

Bloomberg Second Measure

iGMS ADR Growth

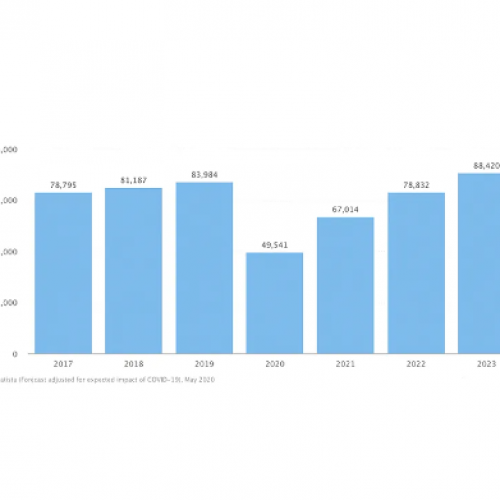

Statista Global STR Revenue

Get started

Request your investor pitch deck today to get started on your way to investing.

Info

Address

1525 W. 15th Street

Davenport, IA

52803